Digital Invoicing FBR | Digital Invoicing Software - How it Works?

Don’t Risk Compliance with Trial-and-Error Integrations

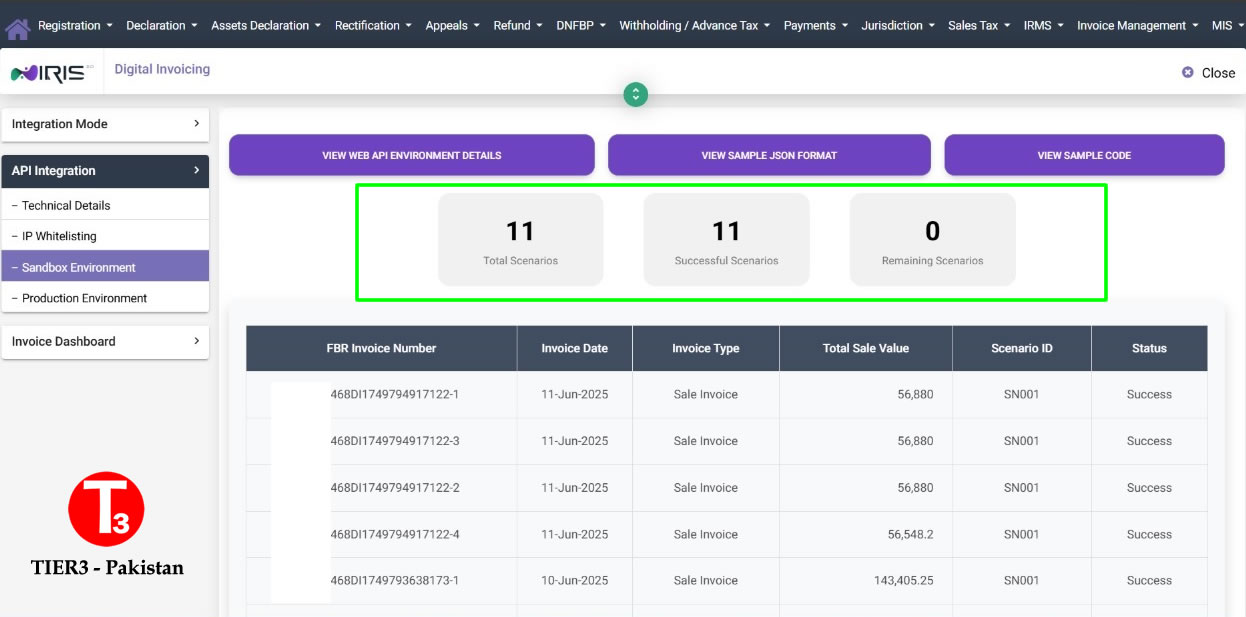

FBR’s sandbox environment, scenario validations, and production handover require precise implementation — this is not a playground for learners and beginners.

Many businesses waste weeks — even months — relying on inexperienced or learning-stage developers who struggle to understand sandbox mechanisms, API documentation, invoice structures, sale types and necesary scenario testing protocols.

This leads to failed submissions, compliance delays, and frustrated teams. Worse, by the time production access is needed, most “DIY” setups collapse under FBR scrutiny.

With our professional software development team, your FBR Digital Invoicing compliance — sandbox to production — is handled start to finish in **under 1 week**, guaranteed.

Don’t risk your tax process with trial-and-error freelancers. Choose expertise, speed, and full compliance from Day One.

Our AI-powered, web-based FBR Digital Invoicing Software makes sales tax reporting simple and fully compliant with the FBR Digital Invoicing API. Here’s a clear overview of how it works:

Digital Invoicing FBR - Step-by-Step Process

- Connect to FBR Sandbox: We first connect your system to the FBR sandbox API environment for safe testing and validation.

- Upload Sales Tax Invoices: You can easily upload your invoices in PDF or Excel format (Your own invoice template) to verify that our AI models and LLM correctly read and map all necessary data as per FBR standards.

- API Data Mapping & Submission: The extracted data is mapped to the FBR Digital Invoicing API structure and submitted securely. Simultaneously, the same data is saved in your own database.

- Receive FBR Digital API Response: Our system handles the response, embeds the transaction code, transaction number, QR code, and FBR logo back into the invoice that you uploaded (Your own Invoice template) .

- Download Updated Invoice: A new, compliant PDF is instantly generated with all required FBR elements and offered for download, email, or print.

- Go Live (Production): Once all test scenarios are verified and approved in the sandbox, we seamlessly migrate your connection to the FBR production environment for live reporting.

Excel Bulk Upload & Batch Processing for FBR Digital Invoicing

Streamline FBR digital invoicing and reporting with our bulk uploader. Upload entire spreadsheets at once, auto-group line items by Invoice Number, and instantly calculate Exclusive Value, GST, and Further Tax from HS Codes with clear, human-readable summaries. Validate your salestax invoices one-by-one or in batches against the official FBR digital invoicing API, review results, and submit to FBR with a single click. Every step is audit-ready with complete logs, and successful submissions are stored securely in database. Watch the demo: FBR Digital Invoicing — Bulk Upload Invoices.

This secure workflow ensures your business remains fully compliant with FBR e-invoicing regulations, while automating tedious manual data entry and validation.